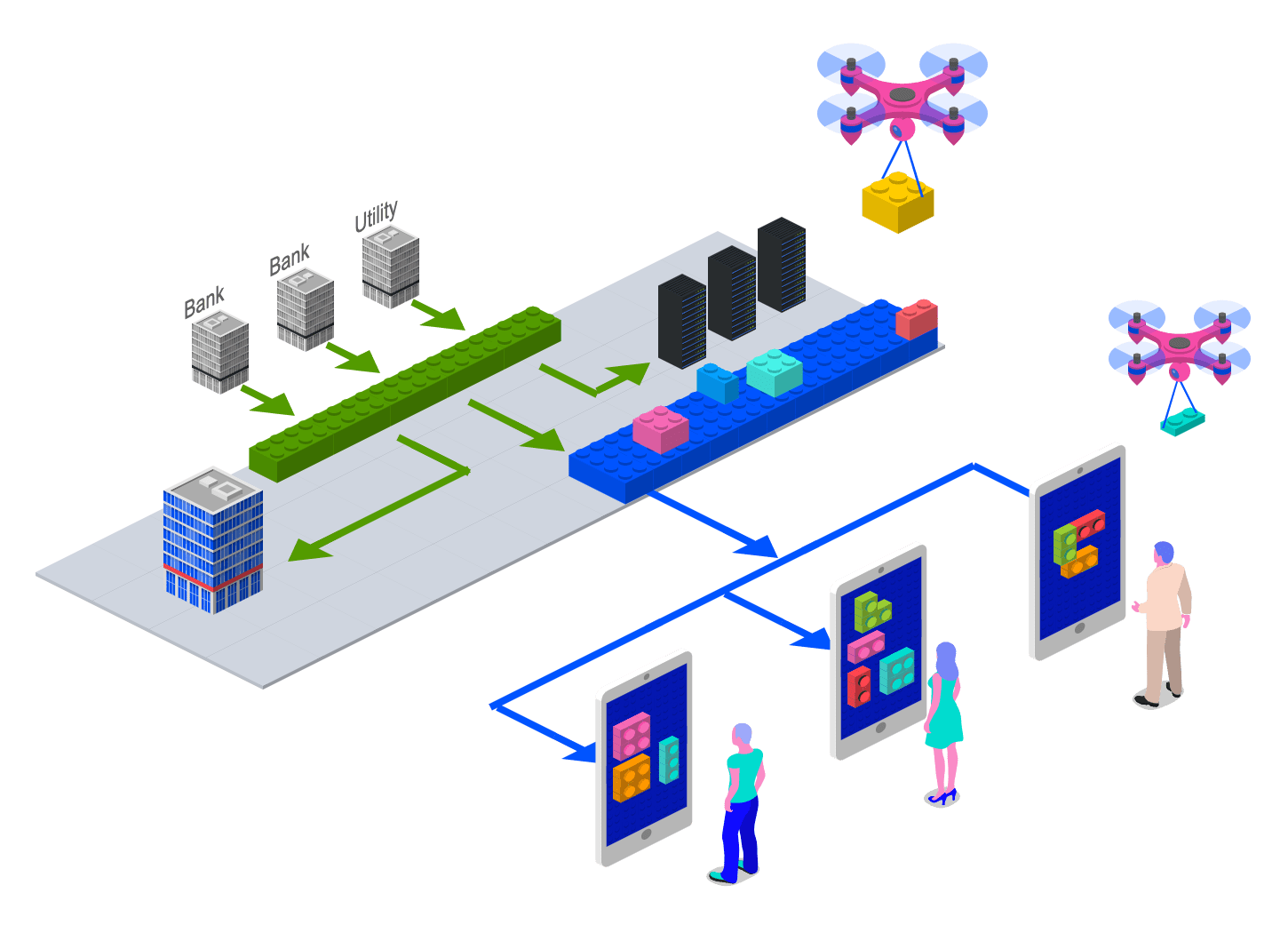

BUILT FOR YOU.

FROM ACCELERATING INNOVATION AND STRENGTHENING CUSTOMER ACQUISITION POWER TO INDIVIDUALLY CUSTOMIZABLE MOBILE FINANCIAL EXPERIENCE

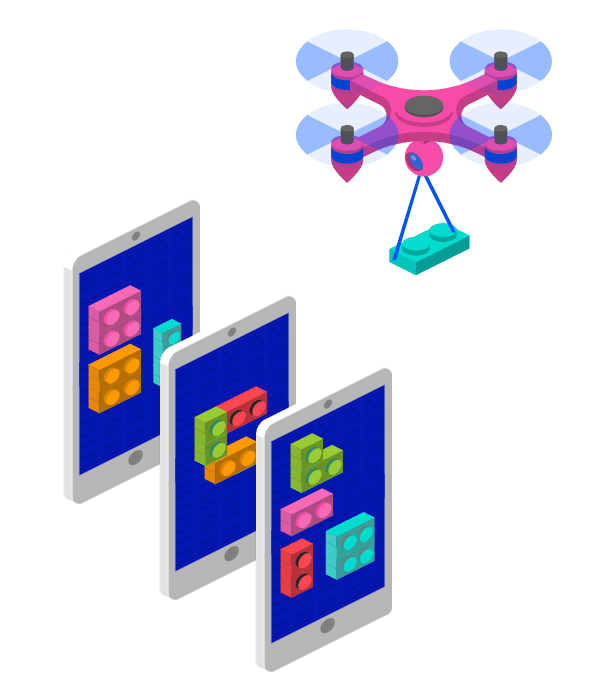

#1 FintechX app

MOBILE EXPERIENCE FULLY CUSTOMIZABLE BY THE CUSTOMER

#PLUG&PLAY BANKING EXPERIENCE

#CUSTOMER DRIVEN BANKING

#HUMAN-CENTERED BANKING

USE

CASES:

- Increasing customer acquisition potential by raising customer experience.

- Expanding mobile presence.

- Keeping the primary communication (Single point of contact) to the users.

MORE

VALUES:

Integrating the fintech solutions of the FintechX marketplace, FintechX app can be expanded as the business needs require. We continuously widen the range of applications we offer on the marketplace.

BUSINESS

CUSTOMERS:

- Financial service providers: banks, insurance companies, investment service providers/brokers

- Payment services providers (payment gateway)

- Utility and telco companies

- Large corporations

- Accountants, online invoicing companies

Built for You

Financial service providers who understand that soon the question will be which mobile app the customer uses to manage his finances rather than which bank has his current account.

Non-financial service providers with wide reach to customers, that plan to introduce finance-related bank-independent mobile services with the aim to raising customer experience.

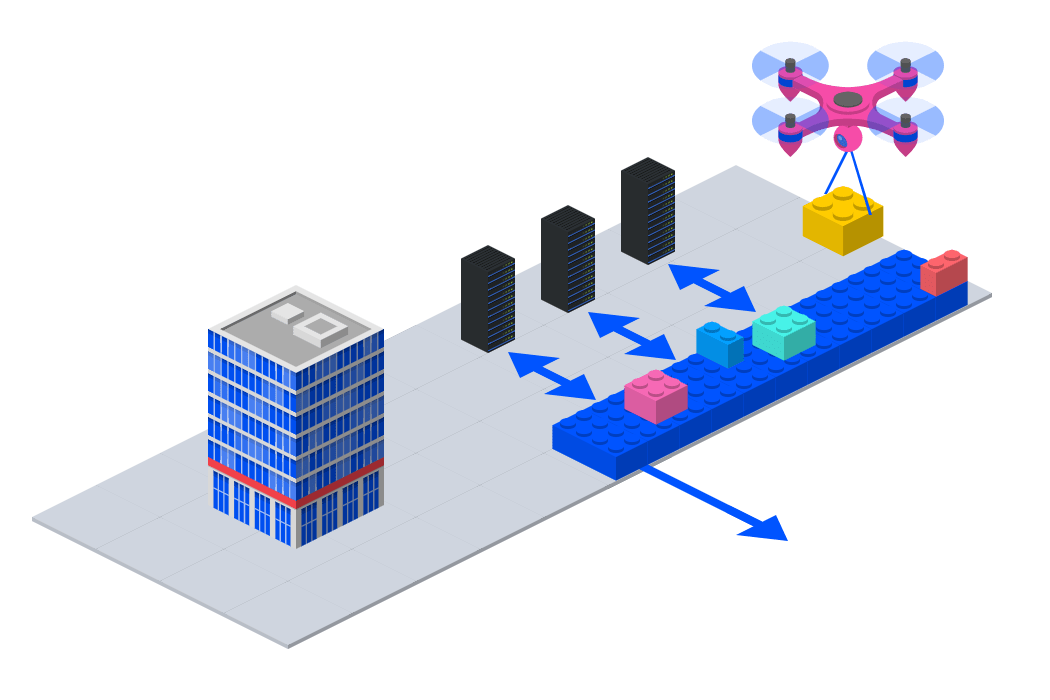

#2 FintechX link

INCREASE CUSTOMER ACQUISITION AND SALES

#MULTIBANKING

#OPEN-BANKING-AS-A-SERVICE

USE

CASES:

- Multibanking

- Credit scoring

- Risk analysis

- Personal Finance Management

- Liquidity management

- Targeting

- Tariff calculation

- Accounting and invoicing related services

- Payment services

MORE

VALUES:

- Data enrichment

- Cross sell

- Increase customer acquisition power

BUSINESS

CUSTOMERS:

- Financial service providers, insurance companies, investment companies, mediators/agents

- Payment services providers (payment gateway)

- Large corporations

- Utility and telco companies

- Accountants, online invoicing companies

Built for You

- Financial service providers that want to increase their customer acquisition potential by utilizing payment account based data enrichment solutions.

- Banks that would use a technical service provider, or an AISP API aggregator to access account information from different banks.

- Registered account information service providers (AISP), licenced payment initiation service providers (PISP) that would use API aggregation-as-a-service.

- Businesses (e.g. payment service providers, large corporations, accountants, online invoicing companies) that plan to introduce alternative financial services.

If you are not registered as an AISP, you can still harness the business opportunities of current account data enrichment with our RegComp solution.

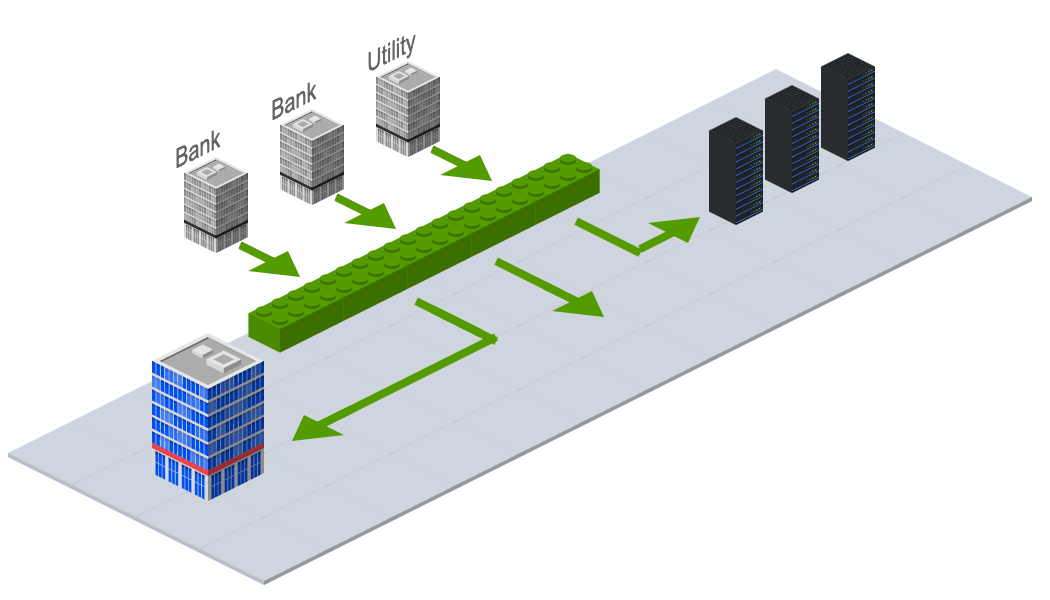

#3 FintechX build

ACCELERATE INNOVATION

#CLOUD BANKING

#FROM-PRIVATE-TO-PUBLIC CLOUD

#TWO-SPEED IT

USE

CASES:

- Increasing in-house innovation capability and introducing in-house and outside fintech solutions rapidly.

- Increasing operational efficiency due to the distributed runtime environment.

MORE

VALUES:

- Quickly complying with regulatory requirements.

- Optimizing infrastructure costs.

- Ensuring cloud based operation.

BUSINESS

CUSTOMERS:

- Financial service providers, banks, investment companies, intermediaries/agents.

Built for You

- TIER 1 and TIER 2 banks, financial services providers that operate in several countries: in addition to successful rollout of central development projects, they can facilitate rapid movement of innovations between subsidiaries, as well as enabling the implementation of bottom-up projects.

- TIER 3 and TIER 4 banks, service providers lacking proper middleware infrastructure.

- TIER 1- TIER 4 banks, service providers, that are preparing for cloud based operation.